The Impact of Global Events on Currency Markets: How Shifts Shape the World Economy

18/08/2025

Author: Kamrul

The impact of global events on currency markets is powerful, influencing exchange rates, investor confidence, and the economic balance of nations worldwide.

The currency market is more than just numbers moving on a screen—it is the heartbeat of global trade, investment, and confidence. Every global event, whether political, economic, or humanitarian, leaves its mark on exchange rates and investor decisions. For many people, the value of a currency can determine the price of food on their table, the cost of travel, and even the stability of their jobs.

Political Turmoil and Currency Shifts

Politics plays a critical role in shaping currency values. Elections, leadership changes, or unexpected geopolitical conflicts can shake investor trust, causing money to flow out of a country and devaluing its currency. On the other hand, when stability and clear policies prevail, investors feel confident, strengthening that nation’s financial standing. The emotional connection is simple—uncertainty scares people, and fear often weakens currencies.

The Role of Economic Decisions

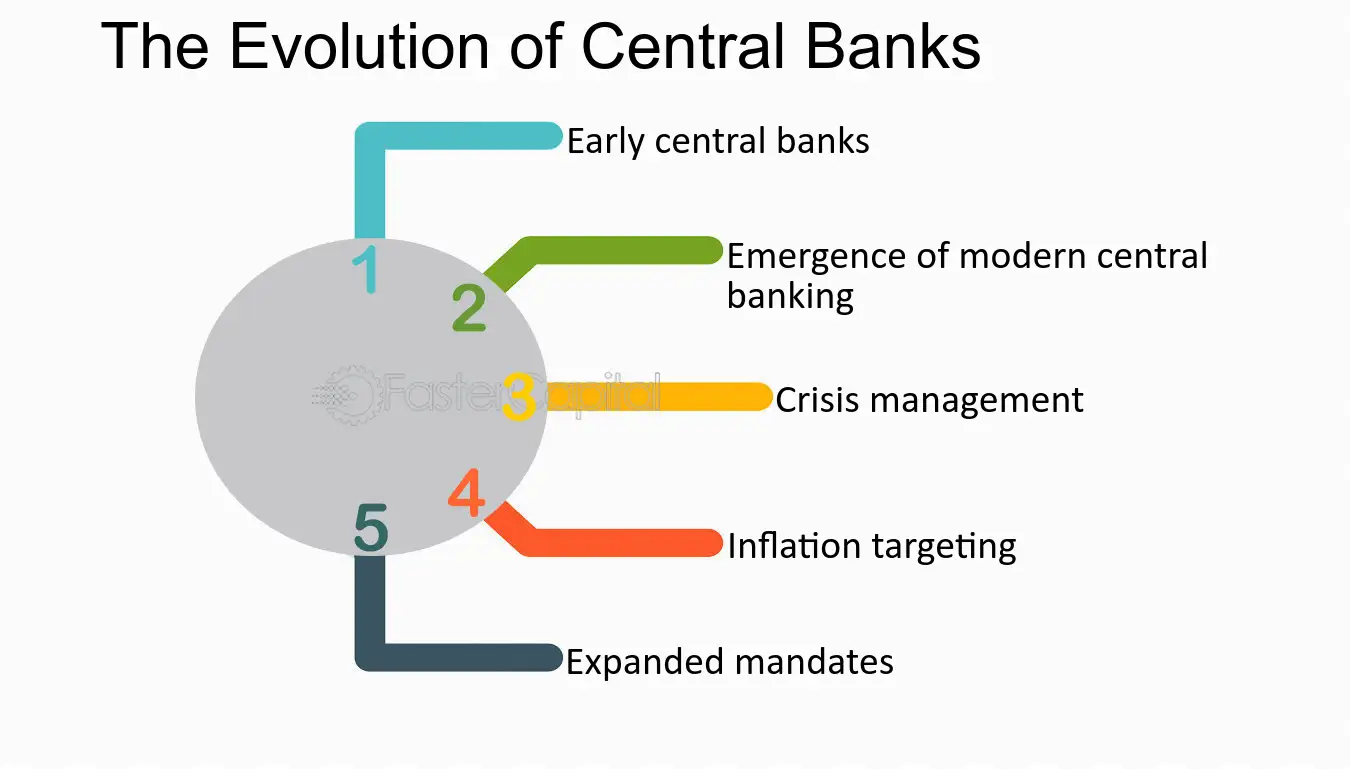

Behind every currency shift, there are central banks and government policies at work. Decisions about interest rates, inflation, or trade policies ripple across global markets. When nations open doors to trade or manage inflation effectively, their currencies tend to rise. Yet, trade wars, sanctions, or poorly managed debt can drag them down. These shifts remind us that financial strategies are not just economic choices; they directly touch the lives of ordinary citizens.

Global Crises and Emotional Ripples

Wars, pandemics, and natural disasters create some of the strongest waves in currency markets. When conflict erupts, people rush toward safer currencies, leaving the troubled nation’s economy struggling. The COVID-19 pandemic highlighted this truth: countries with stronger recovery plans stabilized faster, while others faced steep currency drops. Beyond numbers, these events tell a human story—families worried about their savings, businesses struggling to survive, and governments fighting to restore balance.

Safe Havens in Uncertain Times

During global uncertainty, people naturally seek safety. This is why currencies like the US dollar, Swiss franc, or Japanese yen often strengthen during crises. They represent trust and long-term stability, almost like emotional anchors for investors in stormy seas. It shows how deeply psychology and human behavior shape financial trends.

Looking Forward

The future of currency markets will remain tied to world events. Climate change policies, digital currency growth, and shifting global alliances will bring both risks and opportunities. For traders and everyday citizens alike, understanding these connections means being prepared. After all, every headline on the global stage can spark a ripple in the value of money itself.